The Davey Day Trader basket

- Tiago Figueiredo

- Jun 16, 2020

- 2 min read

Updated: Dec 15, 2021

Stonks can only go up.

Several articles released over the last few weeks have suggested that bored retail traders, stuck at home during the COVID-19 lockdown, have been behind the recent surge in stock prices. Homebound with no sports to watch and likely tired of binge-watching Netflix, the story goes that many retail investors have opted to treat their Etrade accounts like a game of neighbor craps, turning to riskier strategies to break the monotony. The sentiment trader had a great post a few weeks ago that emphasized the amount of small lot call options purchases is more than six times higher than it has ever been (See chart below). This type of herding into S&P500 options is a staple of the subreddit blog, Wall Street Bets. The idea is that if enough people conspire to buy options in a given stock, the dealer hedging those options will have to push the underlying higher if the stock increases, given they are implicitly short-gamma in this position. There was a similar scenario earlier in the year when Tesla's stock price jumped over US$ 300 in a week. Of course, the legitimacy of these strategies is, at best questionable.

Enter Dave Portnoy.

The founder of Barstool Sports, Dave Portnoy, has somehow weaseled his way into the cross-market commentary of many institutional client notes. Portnoy has been live-streaming his day trades and has made some appearances on CNBC advertising his positions in the hardest-hit industries (airlines and cruise ships). Recently, he has been bashing Warren Buffet, calling him "washed up." Given that Portnoy has picked up a large following, he's been referred to as the leader of the day traders; I figured it would be a good idea to create a retail favorites portfolio to get a sense of retail positioning in the market. Particularly given that last week we saw plenty of retail favorites get washed out.

Robinhood user holdings.

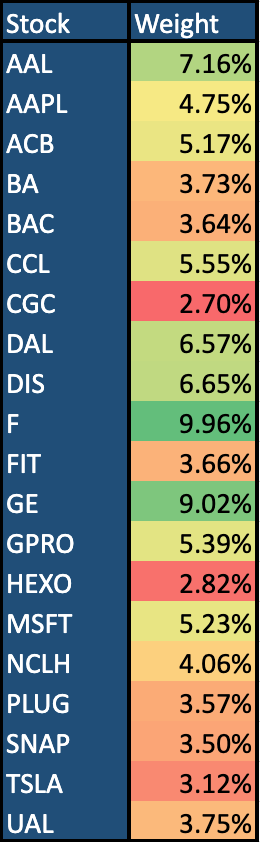

Robintrack is a website that tracks the number of Robinhood users that hold a particular stock in their account. Robinhood is a discount brokerage and is mostly used by retail clients. I use the data on Robintrack to put together a list of the top 20 stocks held by retail investors. From there, I compiled a portfolio of the 20 stocks, weighing them by their relative popularity and rebalancing the portfolio each day. The chart below shows the returns of the basket since the first available data point in May 2018.

Last week's massacre.

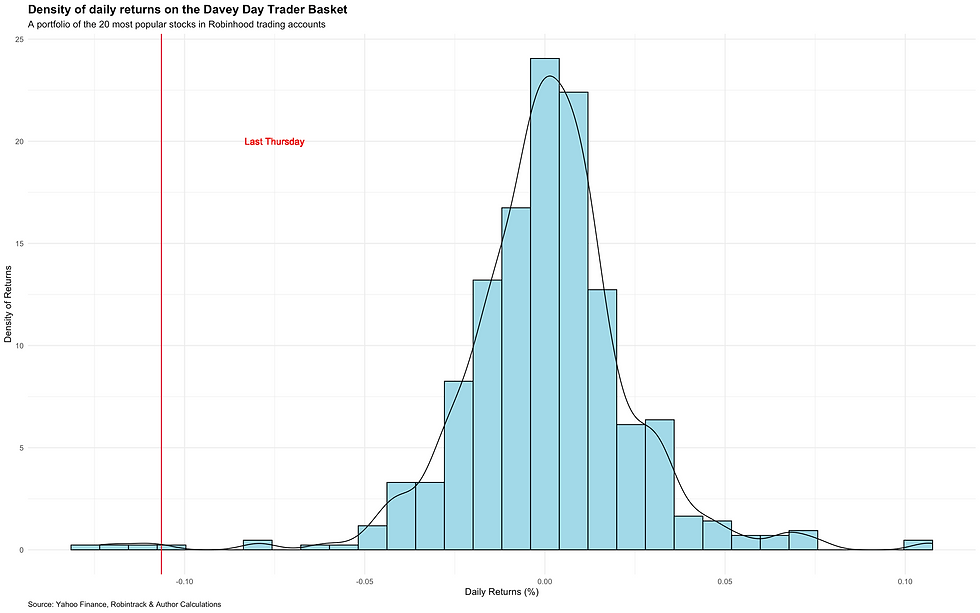

Last week the market had a bit of a hiccup following Chair Powell's rather dire assessment of the economy. In reality, I get the feeling there was more to the sell off than just Powell telling the world the economy isn't doing so hot. In any event, the sell off on Thursday demolished positions in some of the retail favorites basket. The chart below shows the density of returns of the basket, with a red bar for last Thursday. The basket was down nearly 20 percent over Tuesday, Wednesday and Thursday!

For those wondering, the current basket includes the following stocks.

Thanks for reading,

Tiago Figueiredo

Comments