Return to the dog days of summer?

- Tiago Figueiredo

- Jan 19, 2020

- 6 min read

Summary

The greatest deal ever has arrived. Kind of.

The US is alright.

Lagarde has a few words to say to the Germans.

Carney's last meeting may be a hairy one.

South Korea bandwagoning hard?

China is alright.

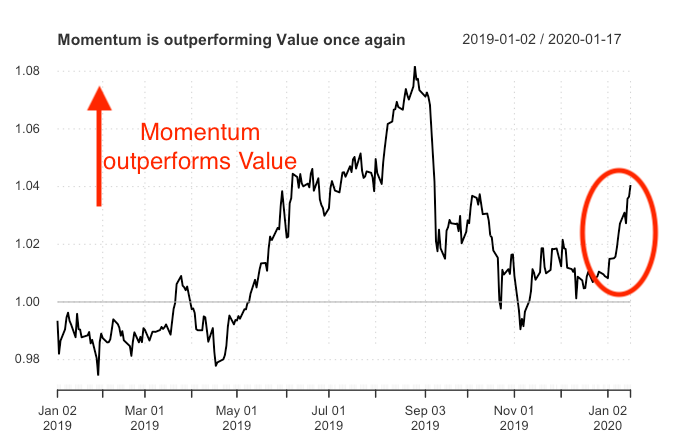

Value underperforming again.

Rolling some large gamma.

Week ahead

Heading into the week, traders were expecting an upset surrounding the "phase one" deal, which never came. The deal signed on Wednesday marks the first in, what the White House insists, will be a slew of mini deals which will culminate in a comprehensive trade policy overhaul. The two sides have agreed to a review period of 10-months intended to verify that China has adhered to the terms of the phase one pact. The market expected a large gap between phase one and phase two. Still, the announcement that no tariff relief is in the cards before the US election in November has market participants cautiously optimistic. For those interested, the full phase one deal can be found here.

Inflation remains a non-issue in the US while the underlying economy continues to motor along. Inflation data out last week came in lower than expected, underscoring the case for the Fed to remain patient while ensuring that the bar for any interest rate increases remains far away from the realm of possibilities. Fed officials reinforced that message indicating their willingness to "let inflation run hot" before raising rates. That may not seem like a bad idea; after all, the US economy continues to do well. There were some fears that retail sales would be weaker than expected following Target's earnings miss (citing lousy holiday sales). However, retail sales came in stronger than expected, growing at a decent clip of 5.8 percent year over year. Bulge bracket banks also reported earnings this week, citing some phenomenal numbers across the board. All in all, the US appears to be entering into a "goldilocks" period where growth remains robust while inflation is moot. That's managed to keep the US 10-year yield rangebound and has limited the gain from any reflation type trades that became popular in late November. With the US yield curve anchored at the front-end due to Fed policy expectations, all shocks will materialize at the long-end of the curve. If we see a rapid steepening of the curve being driven by long-rates, that could mean the goldilocks period is over and will likely result in a significant unwind in any duration type trades which have become popular once again (see momentum/value chart at the bottom).

Germany closed off 2019 by posting the worst annual growth in 6-years, reminding the world of how damaging the trade war between the two largest economies has been to the global economy. The world's 4th largest economy, Germany, remains plagued by a manufacturing recession that has swept across the globe following a massive pullback in business investment and CEO confidence. For many policymakers, the fear is that a slowdown in manufacturing spreads to other sectors of the economy, particularly the service sector. Fortunately, that hasn't been the case in Germany, where we see an apparent decoupling of the two industries. That might be what officials in Berlin have been holding onto to explain why Germany continues to run a fiscal surplus, despite narrowly avoiding a recession in Q3. Of course, the ECB will continue to hound Berlin to spend. The ECB has a tainted image in Germany, and Christine Lagarde is learning German to help fix that... while undoubtedly asking the Germans to spend in their mother tongue.

The ECB meeting minutes showed that there is little desire amongst council members to lower rates further. Indeed, the ECB will likely remain on hold next week, and markets have mostly given up pricing further rate cuts at this point despite continued weak growth and inflation being a country mile away from target. The main development from the ECB will likely be the strategic review, which will involve examining the effectiveness of each monetary policy tool and redefining a medium-term objective that will deliver on the mandate of the ECB. We will likely get more details on that at their meeting this week. It's worth noting that the spread between the 10-year German Bund and US Treasury has narrowed, implying that the market may be pricing in some inflation in Europe relative to the US.

Governor Carney's last meeting at the BoE (Bank of England) is shaping up to be a banger following some disastrous data last week. Following the UK election in mid-December, equity and currency markets got a boost in the hopes that, with a conservative win in place, uncertainty would slowly start to taper off, pent up business investment would be unleashed, and growth would pick up. Such optimism, being coined the Boris bounce, has proved to be short-lived, if at all existent, following some weak data. Industrial production, GDP, inflation, and retail sales have all been less than inspiring through the last quarter of 2019. Markets now expect the BoE to cut rates by 25 bps at their meeting on January 30th. That market action is mostly a function of the incoming data, although the reality is that the outlook for the UK looks bleak. The UK will leave the EU on January 31st, and the focus will shift to trade negotiations. Johnson will be looking for a deal that provides access to the single market of the European Union while preserving the "spirit" of Brexit. If that sounds contradictory, it's because it is. The UK can't have free movement of goods and services without having free movement of people. We are in for an interesting year.

The beat of the fiscal drum got even louder this week with the addition of South Korea's US$ 51 billion in infrastructure spending. The announcement marks a stark transition for President Moon Jae-in's administration, which has struggled to boost growth in the country. A trifecta of global trade tensions, an economic slowdown in China and a slowdown in the market for memory chips has wreaked havoc on the South Korean economy. The Bank of Korea has done its best to weather the storm, cutting rates twice in the last 12 months with some success. Economic data has rebounded slightly, and price levels have begun to rise after slipping into deflation at the end of last year. How sustainable the recovery in South Korea is will depend on whether we start to see any meaningful turn around in China and Germany.

Chinese data last week came in above expectations, providing a much-needed checkup on the world's second-largest economy. Chinese retail sales, industrial production, and fixed asset investment all grew more than expected in December of last year, which, at first pass, looks like a good sign. There's some concern that these figures may overstate the recovery following some rumours that companies were ramping up production going into year-end to front-run any potential increases in tariffs. Of course, the headline GDP number closed the year off with the slowest growth in 29-years, a reflection of the ongoing transition from an investment-driven economy to a consumption-driven one. That slowdown will persist in the new year given that Chinese authorities have indicated a soft target of "around" 6 percent growth for 2020. For the PBOC (People's Bank of China), it will likely be more of the same, i.e.; policy will continue to ease gradually. Barclay's analyst, Jian Chang, is calling for around 100-150 bps of easing for 2020.

The US equity market continues to climb relentlessly to record highs as investors resort to the low inflation trades that have worked over the past several years. Yields in the US have remained rangebound, and inflation expectations benign, driving a sort of "under the hood" reversal in various equity factors tied to lower interest rates. The chart below shows a simple visual of the relative performance of momentum (buying the top-performing stocks) and value (more business cycle sensitive stocks) as an example.

Risk parity strategies have been allocating more to equities, given that realized volatility has collapsed in equities. Record long gamma has helped keep markets in a "gamma trap", limiting upside and downside. That has resulted in lower implied volatility in equities and higher allocations for funds that use volatility as a toggle to deploy funds. The lower implied volatility originating from large dealer gamma has also resulted in a steeper term structure for the VIX (1-month implied volatility). That creates more incentive for market participants to partake in roll-down strategies on the VIX term structure. With that in mind, that may all change after Friday's option expiry, which saw a lot of dealer gamma be taken off the market. The question now is whether those option positions are rolled and, if so, how far out are they rolled. Should we go back to a shorter gamma position, then we could very well enter into a market, not unlike the one witness in the dog days of summer last year.

The world's elite will meet in Davos for the annual World Economic Forum this week.

The forum will feature a substantial discussion on Climate change as well as fair economic policy and proper uses of technology. In Canada, the Bank of Canada (BoC) will meet on Wednesday and likely leave interest rates unchanged. Canadian data has run relatively weak as of late and, while the Governor has tilted more dovish as of late, it's unlikely to be enough to result in a cut to the benchmark rate. As mentioned above, the ECB will also announce interest rates and is expected to remain on hold.

Tiago Figueiredo

Comments